A book that does not look new and has been read but is in excellent condition. No obvious damage to the cover, with the dust jacket (if applicable) included for hard covers.

No missing or damaged pages, no creases or tears, and no underlining/highlighting of text or writing in the margins. May be very minimal identifying marks on the inside cover. Very minimal wear and tear.

See the seller’s listing for full details and description of any imperfections.Seller Notes:“ Former Library books. Great condition for a used book!

Minimal wear. 100% Money Back Guarantee. ”Format:PaperbackLanguage:EnglishPublication Year:1996Special Attributes:EX-LIBRARYISBN:438EAN:438. Product IdentifiersPublisherMcGraw-Hill OsborneISBN-32ISBN-22438eBay Product ID (ePID)387004Product Key FeaturesFormatPaperbackPublication Year1996LanguageEnglishDimensionsWeight24.2 OzWidth7.4in.Height0.7in.Length9.1in.Additional Product FeaturesDewey Edition21Dewey Decimal332.024/IllustratedYesCopyright Date1996AuthorPeter WeverkaNumber of Pages304 PagesLc Classification NumberHg179.W477 1996Publication Date1996-10-01Lccn97-106638.

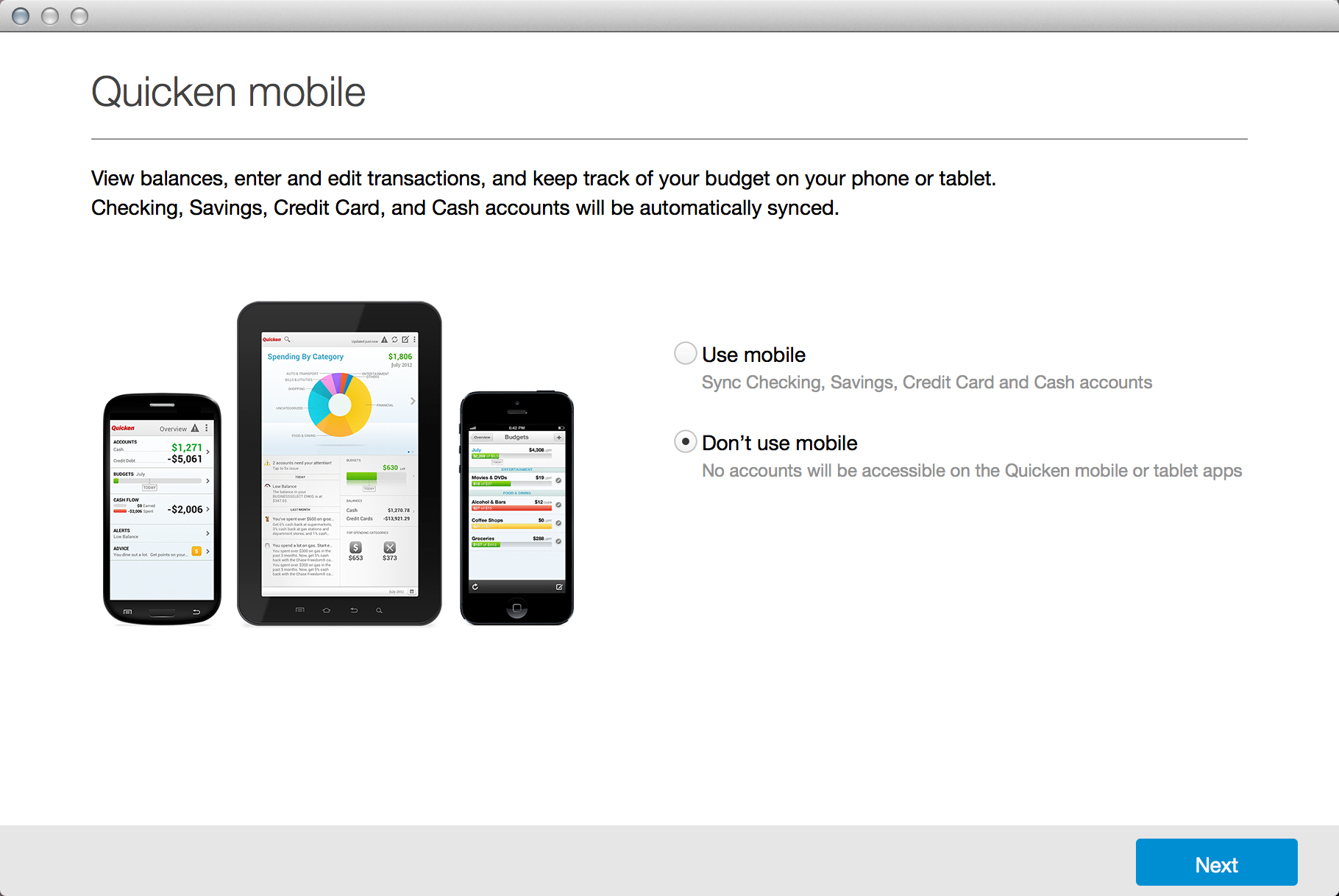

If you're looking to replace, you're in the right place.For years, Quicken was the best personal finance budgeting and bill management package.But over the years, other companies have built their packages from the ground up and use far newer codebases. They use technology that runs faster, connects with other financial companies better, and just has fewer issues doing regular tasks.With software, you want it to work. You want to handle your business and not have to fight with the software to get it to work.But let's accept reality – Quicken breaks a lot. It doesn't sync your accounts randomly, you have password problems, screens that should appear are blank, and it's just not a great experience anymore. Sometimes it feels like they're just getting you to buy the newer version, right?The bottom line:If you're tired of Quicken, its, and want a suitable free alternative or replacement – we have some options.Here are some of the best Quicken alternatives available: Our Best Picks. Hands down the best spreadsheet automation tool on the market. If you want to move to a spreadsheet you can customize to exactly what you need, Tiller will pull the data for you.

Individual Account QIF importing. Budgeting. Running register balances. Account reconciliation. Graphs for Income & Spending. Recurring transactions.

Investment balances by Institution. Memorized transactions. Split transactions. Description renaming.

Tractor unit hauling tractor units inIn, the combination vehicles made up of a powered truck and one or more semitrailers are known as 'semis', 'semitrailers', 'tractor-trailers', 'big rigs', 'semi trucks', 'eighteen-wheelers', or 'semi-tractor trailers'.The typically has two or three; those built for hauling heavy-duty commercial-construction machinery may have as many as five, some often being.The most common tractor-cab layout has a forward engine, one steering axle, and two. The fifth-wheel trailer coupling on most tractor trucks is movable fore and aft, to allow adjustment in the weight distribution over its rear axle(s).Ubiquitous in Europe, but less common in North America since the 1990s, is the configuration, where the driver sits next to, or over the engine. Cabovers were difficult to service; for a long time the cab could not be lifted on its hinges to a full 90-degree forward tilt, severely limiting access to the front part of the engine.As of 2016, a truck could cost US$100,000, while the diesel fuel cost could be $70,000 per year. With changes in the US to the maximum length of the combined vehicle, the cabover was largely phased out of North American over-the-road (long-haul) service by 2007. Rigs of rods unmarked police car photo.

Invoicing5.is a freemium budgeting tool that uses calendars and the concept of “event-based budgeting.” Being calendar based means that rather than viewing your transactions as merely a long list of transactions, the calendar helps you understand when those transactions are happening and if they are doing so on a regular basis. This helps inform you about your spending and one of the more visual ways, when compared to others on this list.It's freemium with the Basic option giving you 12 budgets, 2 accounts, and the ability to project 6 months into the future. If you upgrade to the Premium level, which is $9.95 per month or $7.50 when you pay annually, then you get automatic transaction importing (you can still do it manually if you wish) as well as categorization of spending.

You also get unlimited accounts and projection out to ten years. The Super, which is $19.95 per month or $14.16 when paid annually, gives you unlimited accounts and 30 years projection.We do have a promotion code for Pocketsmith, gives you 50% off the first two months of Premium – make sure to enter the code 50OFFPREMIUM-5G7T to get 50% off the first two months.6.You might have heard of these guys since they're now owned by the same company that once made Quicken.Intuit acquired them in 2010 and that's the reason why they shuttered Quicken Online shortly thereafter.Later, Intuit sold Quicken to H.I.G. Capital and that's when you knew the end was near!Why it is a good alternative to Quicken: Mint is free and very powerful on the budgeting and expense tracking side. They do not have much to help you with investment and retirement savings, which I think you'll find is a huge limitation as you get older. The goal of Mint was always to be a budgeting app and with that in mind, they do a very good job.If you are sick of Quicken and focus entirely on expense tracking, Mint is a good Quicken alternative. It, like, is cloud-based so there's no software to download, patch, or update.

If you have investments and want to manage those, Mint will not be able to adequately fulfill your needs.7. Status MoneyStatus Money is a free cloud-based budgeting tool that lets you compare your finances with people around the United States.It offers all of the tracking functionality of these other tools, will always be free, but adds the comparison component so you can see how you are performing against your peers and the National Average.Your peer groups are set by your age range, income range, location (location type), credit score range, and housing status (own, rent). This ensures you are getting a true comparison and you aren't compared with someone in another age group, different cost of living, or life phase.You can also build custom groups too if you feel you're in a special situation not captured by basic demographic information.

8.Built specifically for MacOS, Banktivity is a personal finance money manager that will import data from Quicken so you don't lose anything in the transition process. It'll do everything you want in a personal finance app, including budgeting, track spending, schedule and pay bills, monitor your investments (including real estate), and pull data from financial institutions.It also has some powerful reporting options that, if you're a report junkie, you will probably really enjoy building, tweaking, and rebuilding. All this is also possible across iOS devices too with seamless mobile synchronization.It is not free, it costs a one-time fee of $69.99 but there is a 30-day trial (no credit card required).9.MoneyDance is not as well known as some of the other alternatives I've listed but I wanted to mention them because they're one of the few money apps that doesn't rely on the cloud. If you are concerned about your data being stored online, this solution is an alternative that keeps your data local to your computer.You can still link your accounts online, so they pull your transactions automatically, but they only store them on your computer.

You can enter transactions manually if you didn't want to link your accounts.MoneyDance looks and feels like a checkbook, with the check register for transactions, but has charts and tables for reporting. It does budgeting but can also as well, albeit not as feature-rich as others.MoneyDance is free to download and try but it costs $49.99. The free version has all the features as the paid version. The free version's limitation is that you can only enter 100 manual transactions.10.Have you heard of Dave Ramsey?Many folks swear by his approach and is built with that in mind. His approach takes into account human psychology, rather than relying solely on math, and explains why it is so effective.

It also explains why ideas like the debt snowball work so well, we need to work with our biases and tendencies if we hope to succeed. EveryDollar is a budgeting tool affiliated with Dave Ramsey's group, the Lampo Group.Much like YNAB, it's a budgeting tool that uses the principles of zero-based budgeting.In zero-based budgeting, you assign every dollar to a category (or job, in YNAB parlance). It's a level of rigor that can be refreshing or restricting, depending on your personality.

The app itself is beautiful, available on your smartphone, and there is both a free and paid version. The paid version costs $129 a year.(paid version offers phone support and automated transaction importing which is a big time-saver; otherwise, you must manually enter the data)11. GoodBudgetis a free budgeting app based on the envelope budgeting method.

Envelope budgeting is when you set aside a prescribed amount for each category of spending, then spend it down each month.It's one of the most popular money management techniques in personal finance. The envelope refers to the manual method of managing these types of budgets where you put the money into an envelope.

When you run out of money, you either borrow cash from another envelope or you make do.GoodBudget adds technology to the mix and will synch up bank accounts to help track your income and your spending. You set the amount for each category and then watch as your spending nears the limit each month. It's available for both iOS and Android phones.

GnuCashis a free open-source accounting software that, if you're willing to put into the work, can replicate a lot of the Quicken experience for those who are willing to scale the learning curve. It features double-entry accounting (every transaction must debit one account and credit another), which is effective but will require an adjustment if you're not used to it.It offers a lot of the functionality of Quicken like splitting transactions, categorizing transactions, managing multiple accounts, schedule transactions, and reporting that includes all kinds of charts and reports (balance sheet, P&L, portfolio valuation, etc).The big benefit is that it does budgeting as well as investments. It's not strictly a budgeting tool.Lastly, it offers QIF importing, so you can import your Quicken files, plus OFX (Open Financial Exchange) protocol. So you can pull in your data if your bank offers you the ability to export transactions. Dollarbirdis another personal finance app with an eye towards collaboration and a monthly calendar. You synchronize your accounts (banking, brokerage, and credit cards) with Dollarbird and they build a schedule of future income and expenditures to help with planning. Dollarbird also offers a 5-year financial plan that lets you establish longer-term financial goals and track your performance against them.The innovation they bring to the table is the idea of calendar-based money management.

You can collaborate with other people (partner, family, or a team) to manage a team budget, though the collaborative piece requires the Pro version ($39.99 / year). MoneyWizOf all the alternatives on this list, I know the least about despite them being around since 2010.

They support practically every operating system you can imagine – everything from Windows to Android to iOS devices like the iPhone and iPad – and it'll synch them in real time.It's a powerful budgeting tool that integrates with 16,000+ banks in 51+ countries – which includes cryptocurrencies if you're in that investment class. If importing from your financial institution concerns you, you can manually enter data as well and it works just as well. For budgeting, you can work with their categories (which are multi-level) or add your own (and subcategories). You can split transactions, bulk edit, tag, and create powerful reports. It won't pay your bills for you but does have notification features.It's a freemium product with the free version that has all the functionality minus synching across multiple devices and automated transaction downloads. For that, you need to buy the Standard ($49.99) or Premium ($49.99/yr or $4.99/mo).

PocketGuardis a fairly simple budgeting app that links your credit cards, checking and savings accounts, investments, and loans all in one place. It has a complete picture (or at least what you tell it) of your finances but its strengths are in the budgeting – how it updates and categorizes your spending as it happens and looks for opportunities to save. Using your spending, it also builds a personalized budget based on your data as well as the goals you set for yourself.They have a free version and a Plus version. The free version has all that you need for tracking your expenses and keep an eye on them. Plus allows you to add custom categories, track cash transactions like income and bills.

Plus costs $3.99 per month or $34.99 per year. Wallyis the last app on the list because they only handle budgeting. Most people who start using Quicken often do so to help understand their own spending. It isn't until your savings start growing that the investment portion becomes a bigger and bigger piece of the financial picture.If that describes you and budgeting is what you care the most about, Wally may be for you.

It's a beautifully designed app that helps you track your spending and understand your budget. Users have reported a few hiccups with the interface but if you get over the learning curve, and are OK with not having automatic transaction downloads, it's worth a try.It is free though, which is why they can't offer automatic transaction downloads. One could argue that manually entering them puts you closer in touch with your spending.One of these will make a fine replacement for Quicken. Common Questions about Quicken Alternatives What happened to Quicken Online?Intuit created Quicken Online to try to compete with Mint. Near the end of 2009, they gave up and acquired Mint.Afterward, they opted to shut down Quicken Online and sold the entire Quicken unit to H.I.G. Capital in 2016. Quicken Online no longer exists.Quicken does have an online experience, something they've only recently created, but it's not free and it's playing catch up.

What is the best non-cloud-based Quicken alternatives?Some of the best tools out there are cloud-based. Personal Capital, Mint, and many on this list store your information online. If they are somehow compromised, they potentially could leak your data.

They have a lot of security protocols in place to prevent this type of thing but nothing is 100% safe. The ones that do not store your data in the cloud are less powerful but they don't store your data in the cloud.Moneydance Personal Finance, which is included in the list above, is one alternative that is a local program and stores your data locally. It still has the functionality of pulling data from hundreds of financial institutions so it will still save you some time.is a tool that integrates with a Google Sheet (which is cloud-based) and Microsoft Excel (which local). They do store some of your information since they have to get the credentials to pull your data but it's not like other services that contain the credentials and the data. What is a good accounting software alternative to Quickbooks?I haven't used Quickbooks and I'm not familiar with the world of accounting, but GnuCash is often cited as a powerful and free alternative to Quickbooks and Quicken.It has a lot of features present in accounting software, like double-entry accounting and small business accounting, but many folks have success using it as a personal accounting software package. It's a software program you download and install locally, which means it's not cloud-based, and it's completely free.

Quicken 2003 Download

Which of these Quicken alternatives work on Mac?Any cloud-based alternative will work on the PC and a Mac. It's cloud-based so they work in your browser, which makes them operating system agnostic.If you want a piece of software designed specifically to run on Macs, is your best option. It's one of the few personal finance applications built specifically for the MacOS and it has the richest feature-set. Most importantly, especially if you use an iPhone or iPad, it seamlessly integrates among the three. Jim Wang is a thirty-something father of three who is a regular contributor to and has been.Jim has a B.S.

Download Quicken For Windows 10

In Computer Science and Economics from Carnegie Mellon University, an M.S. In Information Technology - Software Engineering from Carnegie Mellon University, as well as a Masters in Business Administration from Johns Hopkins University.One of his favorite tools (, everything I use) is, which enables him to manage his finances in just 15-minutes each month. They also offer financial planning, such as a Retirement Planning Tool that can tell you if you're on track to retire when you want. It's free.He is also diversifying his investment portfolio by adding a little bit of real estate. But not rental homes, because he doesn't want a second job, it's diversified small investments in and a farm in Illinois via. I am not a financial adviser. The content on this site is for informational and educational purposes only and should not be construed as professional financial advice.

Quicken 2009 Windows 10

Please consult with a licensed financial or tax advisor before making any decisions based on the information you see here.Advertising disclosure: I may be compensated through 3rd party advertisers but our reviews, comparisons, and articles are based on objective measures and analysis. For additional information, please review our.